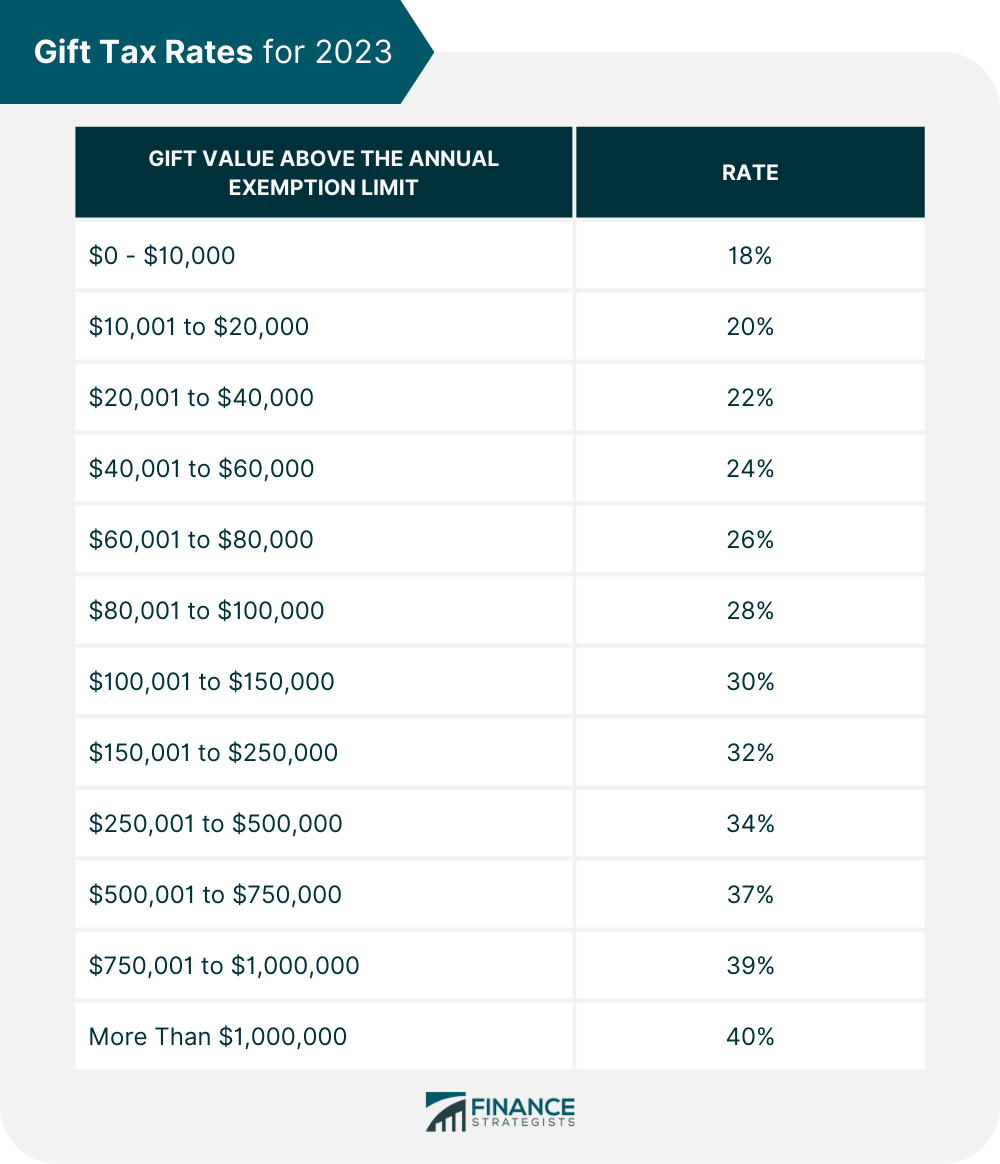

Maximum Cash Gift 2025. Gift tax limits for 2025. Despite a common misconception, federal gift tax applies to the giver.

The exclusion, which is indexed annually (but only in $1,000 increments), is $18,000 in 2025 (up from $17,000 in 2025). Instead, a gift is taxed only after you exceed your lifetime estate and gift exemption, which in 2025 is $13.61 million for individuals and $27.22 million for married.

Instead, a gift is taxed only after you exceed your lifetime estate and gift exemption, which in 2025 is $13.61 million for individuals and $27.22 million for married.

Ordinary monetary and property gifts are unlikely to be impacted by this tax, since the yearly limit for 2025 is $18,000 per giver per recipient.

Significant HSA Contribution Limit Increase for 2025, For example, you only have to file a gift tax return if you give more. The proposal aims to decrease the.

401k 2025 Contribution Limit Chart, For married couples, each spouse could gift up to $17,000, resulting in a combined limit of $34,000. But even if you exceed that amount, there are some.

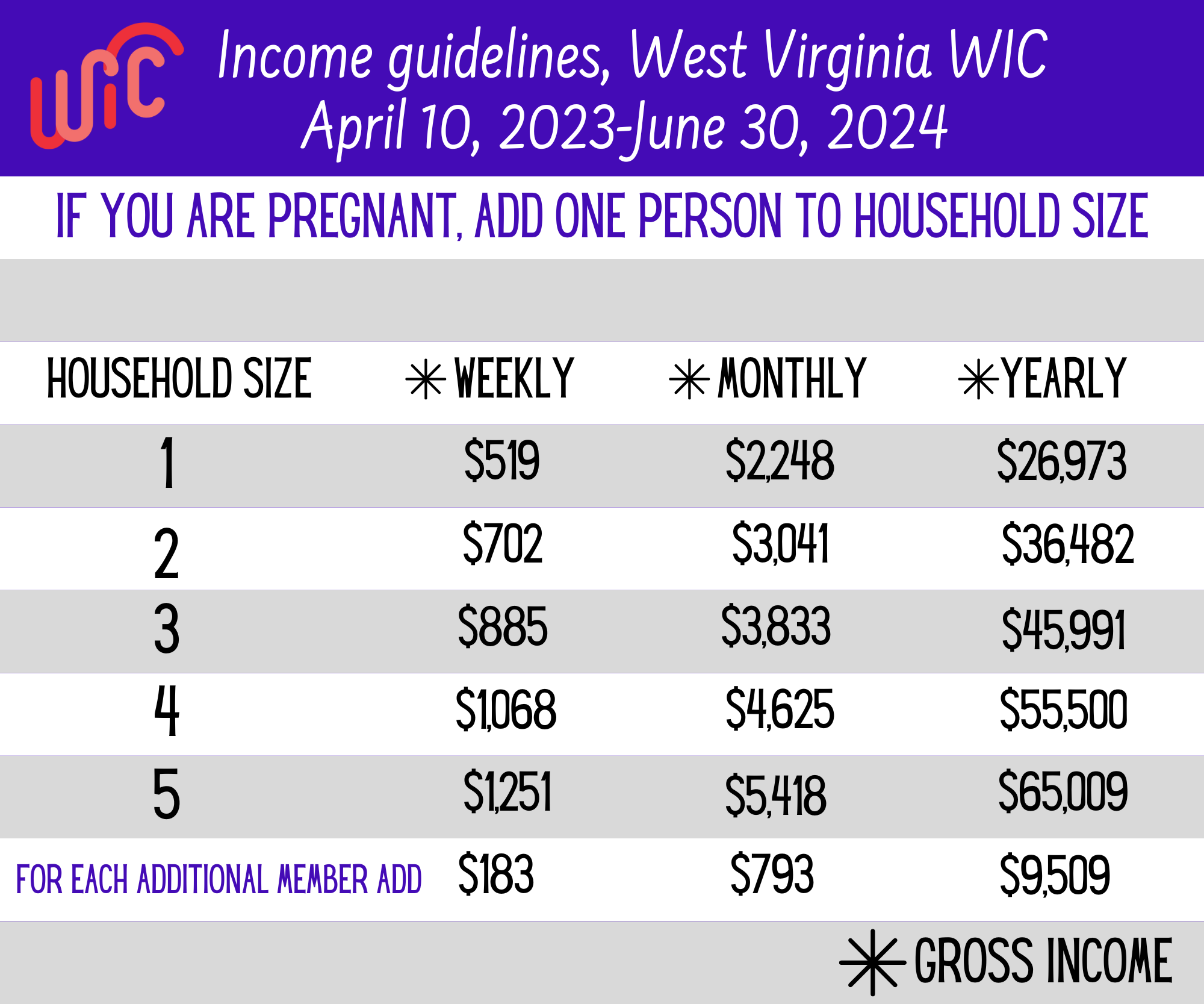

WIC Eligibility Guidelines Monongalia County Health Department, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.). Also for 2025, the irs allows a person to give away up to $13.61 million in assets or property over the course of their lifetime and/or as part of their estate.

Gift Tax Limit 2025 Calculation, Filing, and How to Avoid Gift Tax, In 2025, you can give gifts of up to $18,000 to as many people as you want without any tax or reporting requirements. The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2025 due to inflation.

The Maximum 401(k) Contribution Limit For 2025, In 2025, you can give gifts of up to $18,000 to as many people as you want without any tax or reporting requirements. For 2025, the annual gift tax limit is $18,000.

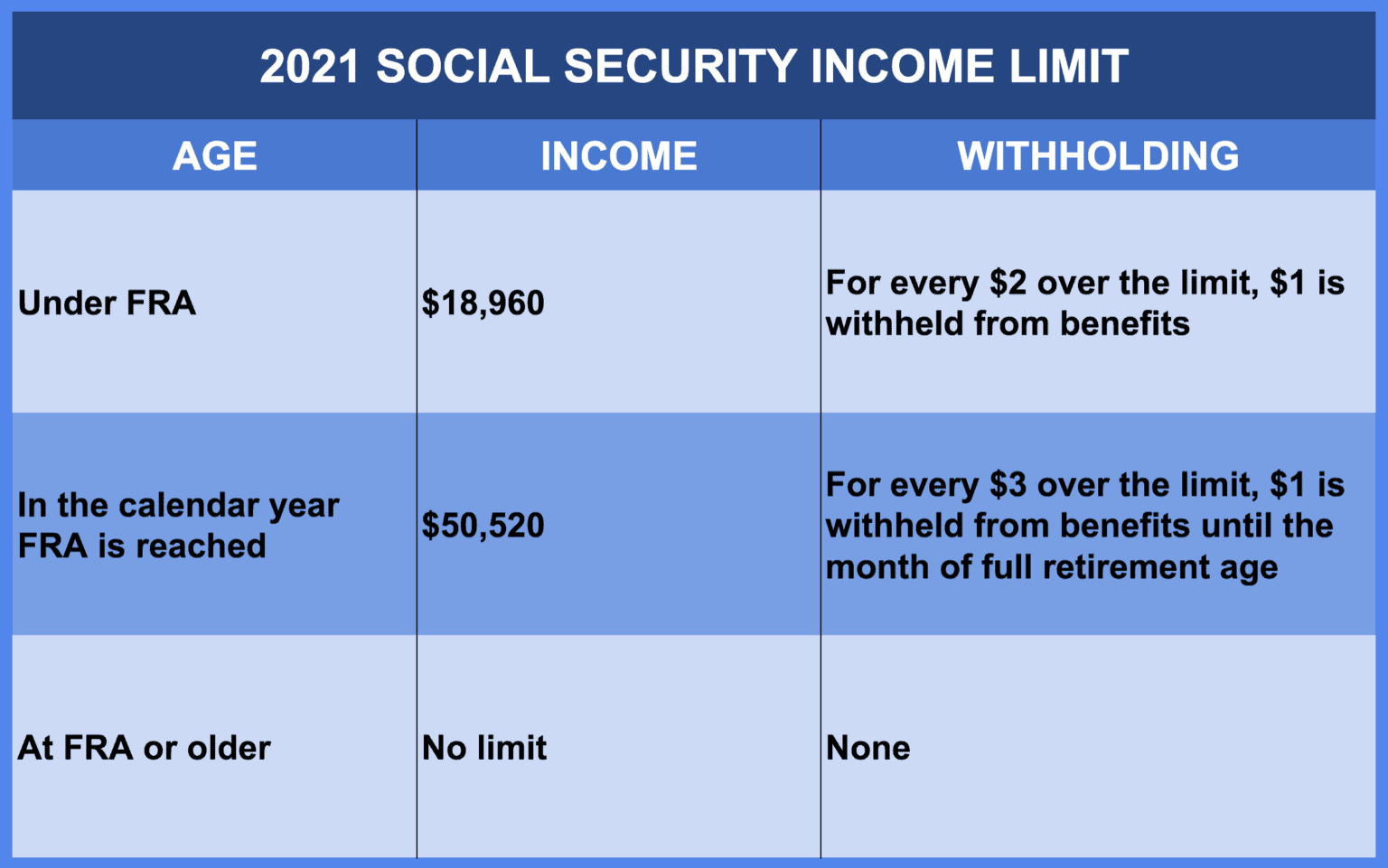

Ss Earning Limit 2025 Beryle Leonore, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.). This means that you can give.

The Maximum 401k Contribution Limit Financial Samurai, This is known as the annual gift tax exclusion. For married couples, each spouse could gift up to $17,000, resulting in a combined limit of $34,000.

Maximum Limit For Roth Ira, This is the dollar amount of taxable gifts that each. If you gifted more than this.

Retirement plan 2025 Early Retirement, This year marks the highest annual gift tax. It’s important to stay up to date with the most recent changes to the gift tax limits.

Gift Tax Limits and Exceptions Advice From an Expert Money, Taxpayers typically only pay gift tax on the amounts that exceed the allotted lifetime exclusion, which was $12.92 million in 2025. The proposal aims to decrease the.